Do you know what the Credit score is? What are the factors that affect your credit score?

We all want to improve our credit score, but before we work on it, we should know what the credit score is?

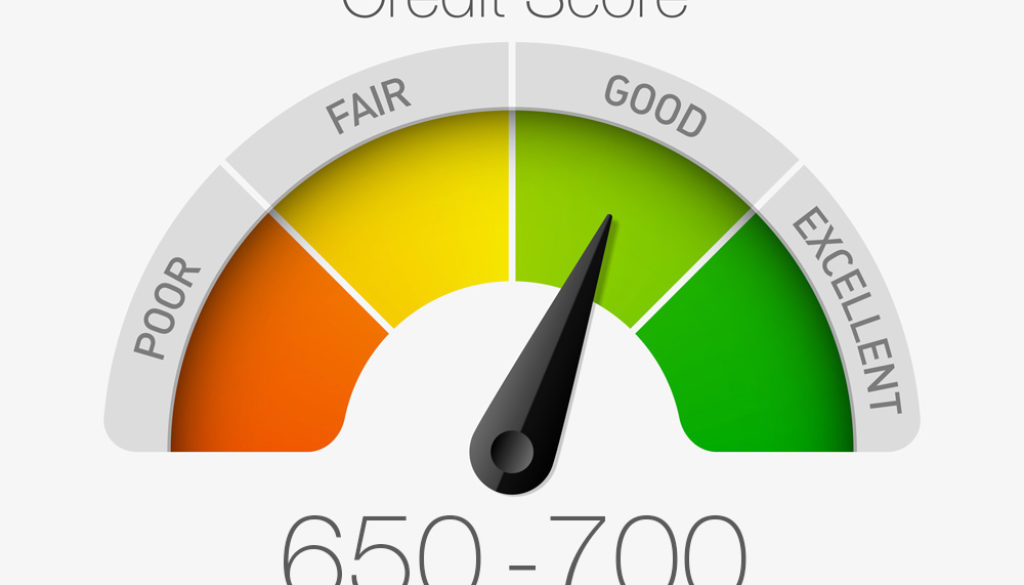

Credit Score is nothing but the score what has been calculated based on the financial transaction you have made in the past. It helps Banks, Creditors or Lenders to understand how you handled your financial responsibilities in the past. If your score is high, they understand you have potential and it involves less risk. If your credit score is good, you can easily get loan or credit card, but the bad credit score will be a pain for you.

There are different agencies that calculate the credit score, and that may differ. They calculate based on a unique algorithm. Here are some tips that can help you to have a good credit score if you follow these tips.

Payment History

The main factor of getting higher or lower credit score. It affects almost 35% of your credit score. This includes your payments history and they check whether you have paid bills/loans in time or you delayed. This will lead you to the bad score or good score. So you should keep consistency on paying all due bills/loans. Don’t miss the payment, and don’t borrow as much as you can’t pay.

Debt Amount

This affects almost 30% of you credit score. They check how much you owe on your credit accounts. You should keep your credit card balance low, and pay the bills on time. If you reach the limit of your credit card every month, lenders will assume it risky.

Length of Credit History

This affects 15% of the score. If you have a longer credit history, lenders will have a good idea and they can make a decision. If you a shorter credit history, lenders will consider other options, like checking your bank accounts. If you have a good bank account history and consistency, you get a green signal here.

Types of Credit that you used

If you have different credit accounts, like Credit Card, home loan, car loan and retail account, lenders will assume it less risky. This affects 10% of your credit score. You can open more accounts to improve the score, but don’t apply for the credit just to improve the score.

New Credit

This also affects 10% of your credit score. If you have opened so many credit accounts in a short period, it will show a negative sign, and Lenders will assume it risky. So open only those credit account that you really need, else don’t push yourself in trouble.